April 28th - WST HS TLK

Cramer's first pick was WST West Pharmaceutical Services Inc.

Closing Price: $35.62

After Hours High: $36.42

Percent Increase at High: 2.2%

Price Level Off Point: $36.25

Percent Increase at Level Off Point: 1.8%

This one already bounced off its 52-week high today, as Cramer mentioned. After the mention it has been taken up even higher. I think I just found out my next research and analysis for the coming weekend. I will take a look at all the stocks that were pushed to new 52-week highs on the Cramer mention and see how they perform the next trading day. Do they continue their momentum and make for difficult shorts or do they drop heavily due to profit taking? Having said that, it might not matter too much with this stock. The price increase isn't great, maybe due to its climb from the $30 range in the last month. Already a sign of profit taking?

Cramer's second pick was HS HealthSpring Inc.

Closing Price: $17.00

After Hours High: $18.46

Percent Increase at High: 8.6%

Price Level Off Point: $17.60

Percent Increase at Level Off Point: 3.5%

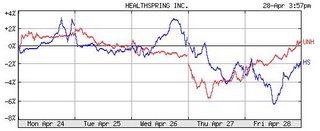

This one has come down from the $23 level in the last month. I did a comparison of the price charts for UNH and HS to see how dependent HS might be on its peers. They do trade in a similar fashion, so I would be a bit wary of another big up day for UNH on Monday propping up HS. If the stock only stays up .60 cents, I won't expect a huge drop. For a stock of this price I would be pretty happy with a .20-cent drop. I would definitely watch UNH in the morning Monday to see if/where it trades in the pre-market.

Cramer's 3rd pick was TLK Perusahaan Perseroan Perseropt PTelekomunikasi Indonesia tbk

Closing Price: $34.50

After Hours Price High: $35.49

Percent Increase at High: 2.9%

Price Level Off Point: $35.00

Percent Increase at Level Off Point: 1.5%

This one trades on they NYSE with pretty low average volume. It has had a big run up this year from the $26 level and the Cramer mention has just given it a new 52-week high, even though it didn't hold there. If the Idonesia market is as hot as Cramer says, and people are paying such a large premium for the Indonesia Fund he mentioned, maybe people will decide to go for individual stocks such as this one. Not really a big enough run up tonight to short yet. I'm curious to take a look at the numbers when it comes to new 52-week highs and Cramer picks to shed more light on this type of pick.

* Rule made not to short in this example. The high after Cramer's mention was below the high for the day. See My Shorting Rules link on the right side.

* Rule made not to short in this example. The high after Cramer's mention was below the high for the day. See My Shorting Rules link on the right side.