May 31st - TNE HXM AMX TTM CIB

Cramer's first picks were a basket of 3rd world stocks. They were TNE HXM AMX TTM CIB

Closing price TNE: $13.12

High: $13.49

Level off price: $13.40

Closing price HXM: $32.58

1 trade at $33.27

Closing price AMX: $32.66

High: $33.00

Level off price: $32.95

Closing price TTM: $16.80

High: $17.49

Level off price: $17.35

Closing price CIB: $27.00

High: $27.62

Level off price: $27.50

All trade on the NYSE.

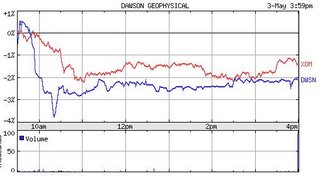

Nothing spectacular after hours as can be seen above. Again I don't like the "basket" picks because people don't like to think, they just want one stock to buy. One would think the "cheaper" picks, namely TNE and TTM would be the ones to look at for shorting. Cramer highlighted TTM back in February. The price then was $17.98 and is only at $17.35, but it has dropped heavily in the last few weeks (no real surprise there) from the high $21 level. The price for TTM does seem to swing wildly on any given day with both up and down. Last time it was highlighted it saw a high of $17.98 and a low after the high of $17.60, but I didn't track the time of the high then.

TNE being the other cheap pick doesn't have a huge % up tonight, only 2.1%. And it is also trading below its high from today so its an ANGO no-short rule again. I said after today and NTGR that I would never question that rule and I'm not going to change that.

So even though Cramer said these stocks don't care about rate hikes in the US, they are still bought and sold by people who are effected by rate hikes. Since Cramer is making fewer picks (no picks in his first segment that last 2 nights now) and is picking stocks from outside the US I get the feeling that he thinks the market has not bottomed. The last few up days we have had have been followed shortly after with big down days. I have a feeling we have a down day tomorrow which will help pull these ones down....but just a hunch. But with any of the picks, I would look out for a spike between 9:25am and 9:45am followed by the quick decline.