October 31st - Sell HANS

Cramer started out with a bearish segment on Hansen Natural Corp. (HANS) in honor of Halloween. He said the company is a scary stock and did a taste test of all the different HANS drinks to see if any of them were even different and of course said they all tasted the same (even though he didn't try them all and was grabbing the same drink as he had his eyes closed). This is a stock that Cramer was behind from somewhere in the $65 range in the last year and and ran it all the way past $100 (the stock did split recently too). He is now saying to get out before they report and has been bearish on it as of late. I'm not one to short a sell pick because as I have said in the past it is not the same game and from what I have seen is that Cramer will bring the stock down (HANS is down around .70 cents after hours as I type) on a sell recommendation and then the non-Cramer watchers wake up tomorrow and see this as a buying opportunity because they don't know why the stock is down on no news and bring it back up. If one were to short this stock I think due diligence should be done and to not just take Cramers opinion on its own. This sort of leads me into something I am developing lately and what I like to call "Instant Homework". As a programmer by trade I have been working on a system that collects data from multiple websites (data from balance sheets, income statements, cash flow statments, analyst estimates etc) for a selected stock and will run a series of calculations to help give some background on the stock which is often spread out over many different sites. Now I hope I didn't mention this too early as I don't know when I will be done programming it, but ideally what I would like to do is post the information for each of Cramer's picks to give the "Long" side of the story and not just about shorting it.

Next Cramer expressed his bullish view on the country of Brazil and recommended owning Companhia Vale do Rio Doce (RIO)

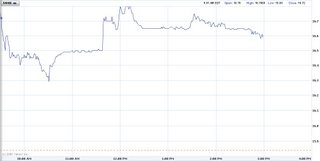

Closing Price: $25.44

After Hours High: $26.10

Percent Increase at High: 2.6%

Price Level Off Point: $26.00

Percent Increase at Level Off Point: 2.2%

Trades on NYSE

Sector: Basic Materials

Short %: 2.04%

Days to Cover: 2.7

% Held By Insiders: n/a

% Held By Institutions: 13.90%

For anyone that watches Fast Money, Eric Bolling also recommended RIO last night. The air seemed to come out of the stock shortly after Cramer recommended and then he put a $40 price tag on it and the after hours price pushed past $26. The price is hovering around $26 which means it will likely be broken tomorrow morning meaning spotting a top tomorrow morning could be a little harder and riskier. This is not a small stock and trades over 7 million shares a day so certainly one to be careful with. It also appears to trade in lock step with Phelps Dodge Corp. (PD) (you can compare 5 day chars on Yahoo! Charts) so keep an eye on that stock to see if it is up or down. If PD is down early tomorrow, then it could bring RIO down off an opening spike.