More analysis

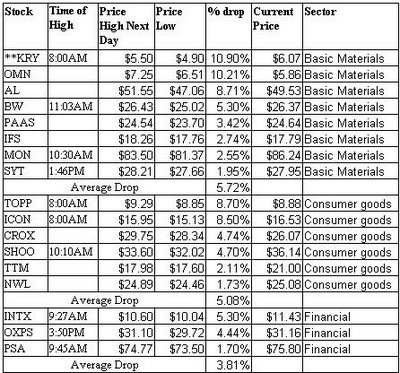

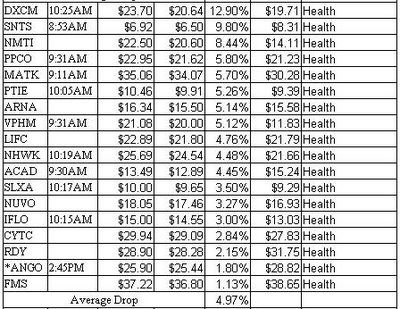

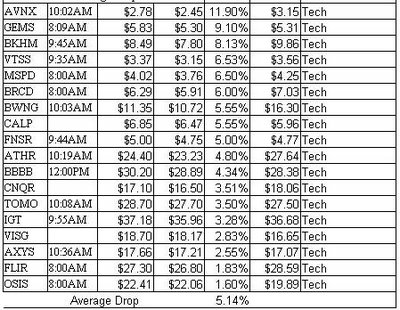

I have compiled most of my data here in this spread sheet. Some of the times of high are missing because I wasn't always taking note of it in the past.

Of the 72 picks tracked here (since late January) 38 of them are below the highs produced in trading the day after Cramer mentioned them, as of Friday. That's 53%. Why is this important? Because several people say that it is much better to short stocks a few days after Cramer has mentioned them when the hype dies down and people begin to sell. But shorting a few days later would only give you a 50/50 chance that the stock will go down. By shorting the next day (or during after hours when Cramer mentions) all of the stocks come down off their highs. This method is certainly not perfect either because it involves timing the short which is not always easy. But only shorting the day after the mention also mean you limit the chance for news to come out that may drive the stock up even more.

The chart below only takes into account price movement during the next day (premarket and regular hours) and not the after hours during Cramer's show. So, some of the highs would actually be higher because often there is a very large spike in price right when Cramer mentions the stock before it settles down.

Looking at the numbers, the higher the price of the stock tends to mean the least profitable for a short. I have mentioned many times that when the prices are higher, people don't want to buy them because they can't afford as many shares so they wait for a cheaper one to buy.

Also, the Services Sector appears to have the least drop in share price from highs achieved from Cramerites buying. Most of the stocks from that industry were higher priced stocks which might attribute to the differnce. Some of them didn't go up that high after the mention, and therefore there was less opportunity for the price to come down.

Otherwise, the other sectors have average drops from their highs of around 5% (excluding financial which doesn't really have enough data to get a very good average).

* Rule made not to short in this example. The high after Cramer's mention was below the high for the day. See My Shorting Rules link on the right side.

* Rule made not to short in this example. The high after Cramer's mention was below the high for the day. See My Shorting Rules link on the right side.

**KRY's high was actually at the end of the day. But if a short was done at the premarket open at $5.50, there was a big decline at 9:30AM that would have produced the 10.90% drop.

Comments on "More analysis"

post a comment