Cramer started out by saying that to make money we need to know what the big money managers do and follow their lead and they obey the business cycle. He said the supermarkets and drug stores is the place to go right now and named several picks he has named several times over, but were not his picks. He then zoned into some smaller hidden names instead, and they were

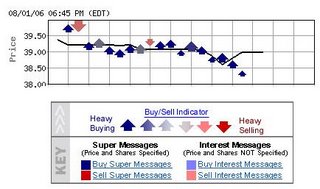

DA Groupe DANONE and

TR Tootsie Roll Industries Inc.DAClosing Price: $28.25

After Hours High: $28.55

Percent Increase at High: 1.1%

Price Level Off Point: $28.52

Percent Increase: 1.0%

Trades on NYSE

Sector: Consumer Goods

Short %: 0.06%

Days to Cover: 8.5

% Held By Institutions: 1.8%

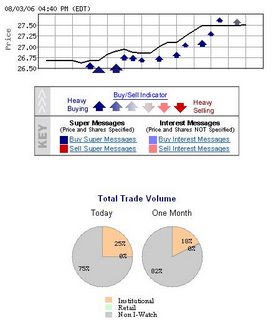

TRClosing Price: $27.73

After Hours Price: $28.13

Percent Increase: 1.4%

Trades on NYSE

Sector: Consumer Goods

Short %: 9.9%

Days to Cover: 17.6

% Held By Insiders: 52.99%

% Held By Institutions: 25.70%

Very light trading after hours so far for both of these picks with small gains. DA has had a few trades and TR only one so far right now. The defensive picks never seem to excite people into buying. Of note though Cramer said he still doesn't like

WWY William Wrigley Jr. Co. even though it is up from the last time he was down on it (as commented on the discussion board

here).

Next Cramer took a stroll to the drug store to find some unexploited plays. They were

CHTT Chattem Inc. MTXX Matrixx Initiatives Inc. and

PRGO Perrigo Co.CHTTClosing Price: $32.12

After Hours High: $32.96

Percent Increase at High: 2.6%

Trades on NASDAQ

Sector: Healthcare

Short %: 19.1%

Days to Cover: 5.5

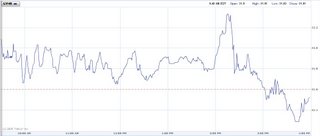

MTXXClosing Price: $16.43

After Hours High: $17.18

Percent Increase at High: 4.6%

Price Level Off Point: $17.00

Percent Increase at Level Off Point: 4.1%

Trades on NASDAQ

Sector: Healthcare

Short %: 9.98%

Days to Cover: 10.8

% Held By Insiders: 2.74%

% Held By Institutions: 78.40%

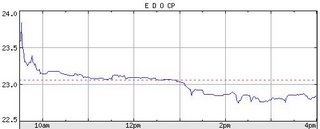

PRGOClosing Price: $15.46

After Hours High: $15.70

Percent Increase at High: 1.6%

Price Level Off Point: $15.65

Percent Increase at Level Off Point: 1.3%

Trades on NASDAQ

Sector: Healthcare

Short %: 8.34%

Days to Cover: 9.2

% Held By Insiders: 24.38%

% Held By Institutions: 70.00%

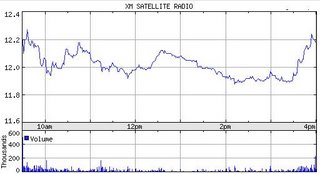

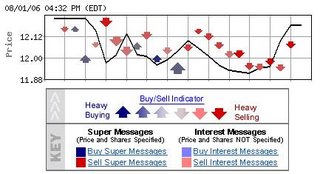

Again, pretty much as expected, not a lot of after hours volume on these picks, although MTXX is up over 4% but the first trade was for 1000 shares which moved the stock as much as it did probably because the average volume is only 81,000 shares a day. And true to Cramer's word that we should follow what the big money managers do, MTXX and PRGO both have large insider/institutional holdings. I haven't seen a definite pattern for trading with these types of picks where the stock is held by big holders, but there is certainly a concern that the supply could be limited if they decide to hold and a lot of buyers come in. Now with these, since there isn't a lot of interest tonight, it is hard to say if there will be more volume tomorrow. Of course the 9pm and 12pm viewers of the show may be interested in these cheaper picks and spur some buying. Cramer has also picked PRGO in the past and here is the chart from the day after:

Of course, the past doesn't necessarily mean the same will happen again. Read the update from last time

HEREFinally, Cramer started a new segment called "Sell Block" where he looked at previous picks that he thinks should be sold now. He spoke about investing vs. trading and how sometimes investments can turn into trades quickly and profits should be taken, for example GYMB and PLCE, even though they are down now. He said

CTWR Coldwater Creek Inc. is a

current example of a picksthat should be sold now and

BMY Bristol-Myers Squibb Co. as a stock that if you own, you should be worried.