Cramer started out with Trend Setting and how California sets them. He spoke specifically about legislation and how it will influence.

The first legislative bill was to tax large square footage stores, which would mean selling

WMT Wal-Mart Stores Inc. now and hope the law gets squashed.

The second bill is the booster seat bill which would require more booster seats to be needed. The stock to buy for this would be

MAT Mattel Inc.The third bill deals with Tele-Com companies and how they will require less red tape basically. This means selling

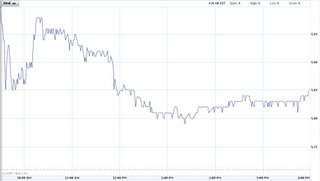

CHTR Charter Communications Inc.MATClosing Price: $19.10

After Hours High: $19.40

Percent Increase at High: 1.6%

Price Level Off Point: $19.20

Percent Increase at Level Off Point: 0.5%

Trades on NYSE

Sector: Consumer Goods

Short %: 1.14%

Days to Cover: 2.1

% Held By Insiders: 0.40%

% Held By Institutions: 87.90%

Big institutional holdings in MAT (the only buy pick...I don't short sell picks) but only a measly .10 cent increase after hours but was up .30 cents, but on light after hours volume. The after hours action isn't always reflective of the next mornings action. For example, today NSTR jumped higher at the 9:30 open then it had traded after hours the night before and the entire pre-market. So with a cheap er stock like this, a 9:30 spike above $19.40 would not be a surprise anymore. And if it does do that, the same quick drop could be seen.

Cramer then continued to look at more potential laws that could have stock impacts.

A bill that would prevent illegal immigrants from being nurses law. This would help

AHS AMN Healthcare Services Inc. This is a stock Cramer mentioned recently and did NOT make for a good short as the stock was stayed very strong the entire day. Even with its attractive price for shorting ($23.99 close), I dare not touch this one here. The stock closed after hours up 37-cents at $24.36 on light volume though.

Next is a bill about requiring a head set when driving with a cell phone. The stock here is

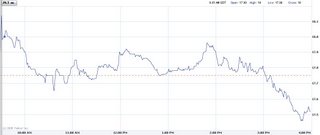

PLT Plantronics Inc.PLTClosing Price: $17.75

After Hours High: $18.22

Percent Increase at High: 2.6%

Price Level Off Point: $18.18

Percent Increase at Level Off Point: 2.4%

Trades on NYSE

Sector: Technology

Short %: 10.07%

Days to Cover: 4.7

% Held By Insiders: 0.92%

The next bill was for all states requiring state issued ID cards. The stock here is

ID L-1 IDENTITY SOL There were no trades during the show for this one. The stock closed today at $14.15 and has a smallish average daily volume of shares at 313,000 so could have some 9:30am spike potential.

Next is a bill banning Lead Pipes. This is good news for

LMS Lamson & Sessions Co. and

PWEI PW Eagle Inc. LMS had no after hour trades during the show and is currently at $25.93 and PWEI was down big today as well as after hours. A few trades have brought it to within 1-cent of the regular close at $33.88.

The next bill is one that will allow dentists to do some forms of plastic surgery.

The stocks here are

PMTI Palomar Medical Technologies Inc. CUTR Cutera Inc. BLTI Biolase Technology Inc. and

MNT Mentor Corp. BLTI is the only one that traded after hours, but for a $5.52 stock, it was only up 2-cents on a few trades.

Next is a bill to lower prices for prescription drugs for medi-care. This will hurt

PFE Pfizer Inc. and

MRK Merck & Co. Inc.Next is a toilet bill that will require less water. The pick here is

ASD American Standard Companies Inc. because it is the best toilet that uses less water.

The next bill is shore up the levies in California and the stock is

URS URS Corp. which had 1 trade after hours taking the stock up 55-cents to $40.09.

Finally, the last bill to potentially influence the stock market was one about fixing roads and the stock was

VMC Vulcan Materials Co. which closed today at $77.39, which is too rich for a short in my opinion, and had no action after hours.

Pre-Market Open: $19.90

Pre-Market Open: $19.90