August 1st - PFE CMCSA

Cramer's first segment looked at his interview from last night and how he didn't realize that there was an expected increase in prescriptions with Medicare part D, but the company did. Cramer then wanted to find a stock that could benefit from this prescription spike and his pick was PFE Pfizer Inc.

Closing Price: $25.99

After Hours High: $26.35

Percent Increase at High: 1.4%

Price Level Off Point: $26.22

Percent Increase at Level Off Point: 0.9%

Trades on NYSE

Sector: Healthcare

Short %: 0.74%

Days to Cover: 2.1

% Held By Insiders: 0.10%

% Held By Institutions: 64.6%

Again, nice to see a lot of buying after hours off a Cramer recommendation. I have a feeling that the more well known and cheap a stock is right now the better chance the stock will get some action after hours. The unfortunate thing here is that we aren't up very much and we are dealing with a VERY heavily traded stock that trades nearly 30 million shares a day. Of course that 65% institutional holding of the stock would have far more control over the price vs. the Cramer buyers. There is a good bet that the institutions will sell into the "spike" in a similar way that XMSR did today, assuming the price doesn't fall right back down to the closing price.

Cramer's next pick was CMCSA Comcast Corp. after it has been looked down upon by analysts and Cramer alike. Cramer has now switched his view and says its a buy.

Closing Price: $34.19

After Hours High: $34.50

Percent Increase at High: 0.9%

Price Level Off Point: $34.40

Percent Increase at Level Off Point: 0.6%

Trades on NASDAQ

Sector: Services

Short %: 1.9%

Days to Cover: 4.1

Apparently not an interesting pick for viewers with no immediate trades after hours. The first after hours trade came in at $34.41, up only 0.6% on 100 shares. Even though CMCSA has more than just VOIP, I wonder if people are scared away from it since Cramer constantly says there is no money in VOIP due to the high amount of competition, and the "Vonage the Dog" factor??

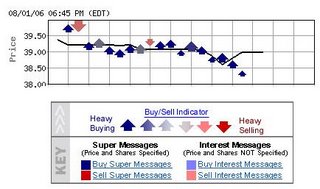

Finally Cramer looked at UARM Under Armour Inc., a stock that he backed before the IPO. He is now saying that the stock is over-valued and put it in his "Danger Zone". This has of course sent the stock down after hours from the close of $39.00 to as low as $37.60, even after being down $1.15 today already. I still think this is still a popular product, and the type of "cool stocks" that Cramer said were good to be in not that long ago. To Cramer's credit though he did say that the stock could go up still, but it is best to take profits now since it has been up so much and its p/e ratio is probably too high for its growth potential. I think this one has great potential for the reverse Cramer effect where the stock is being oversold tonight and will probably rebound tomorrow morning. There is pretty large insider and institutional holders of the stock, 64% and 16% respectively. Might be worth taking a look at I-Watch tomorrow to see if there is some buying pressure with the beaten down price. Looking at I-Watch from today, there was heavy buying pressure even with the stock being down, so someone likes what they see still.

http://thomson.finance.lycos.com/lycos/iwatch/cgi-bin/iw_ticker?ticker=uarm

Comments on "August 1st - PFE CMCSA"

post a comment