Update - HEI HLT MOG-A TGI

Not a great day for the shorts here. HEI opened in the pre-market at $30.11 after trading at only $29.41 after hours last night. It did settle down in the pre-market trading at $29.67 before the bell, but on light trading. Yahoo reports the 9:30am opening price of $29.07. My chart program shows a delay to the opening trade but it looks like we hit a high of $29.36 in the first few trades and quickly took a dip to $29.02 at around 9:47am. A new high was seen after that with a slight dip from that where it traded in a pretty tight range for the rest of the day. Volume was about double the daily average.

HLT got a "positive note" from Merrill Lynch in the morning right near the low price of the day as can be seen in the chart bellow, right around 9:45am. Before that note, it traded at $27.10 in the pre-market on a few trades after hitting the $27.20 level last night. I noted last night that it would have to hit that high again in the morning to make it a worth while short and it never did until later in the day beyond 9:30am. It opened at $27.00 and took a short dip to $26.76 right before the positive note.

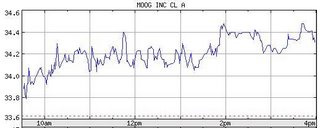

HLT got a "positive note" from Merrill Lynch in the morning right near the low price of the day as can be seen in the chart bellow, right around 9:45am. Before that note, it traded at $27.10 in the pre-market on a few trades after hitting the $27.20 level last night. I noted last night that it would have to hit that high again in the morning to make it a worth while short and it never did until later in the day beyond 9:30am. It opened at $27.00 and took a short dip to $26.76 right before the positive note. MOG-A which didn't participate in after hours or pre-market trading also had a pretty strong, but volatile day. The volume wasn't much higher than the daily average, which was odd considering it was up, but so was the overall market. There really wasn't a dip that can be attributed to Cramer, but it only opened up .25-cents from its previous close so no real reason for shorts to jump on it.

MOG-A which didn't participate in after hours or pre-market trading also had a pretty strong, but volatile day. The volume wasn't much higher than the daily average, which was odd considering it was up, but so was the overall market. There really wasn't a dip that can be attributed to Cramer, but it only opened up .25-cents from its previous close so no real reason for shorts to jump on it. TGI which I had skipped over last night had the most interest in the comments for my post yesterday. Kudos to a poster who did some great research and predicted that it would surge today and it did. I thought the volume wouldn't be there due to the price, which was somewhat right....the volume was 184,000 with an average of 115,000, but the price still shot up. I replied in a comment this morning that the sellers must have kept their ask price high and the buyers were chasing it up. With a large institutional holding in the stock, the float appears to be very limited.

TGI which I had skipped over last night had the most interest in the comments for my post yesterday. Kudos to a poster who did some great research and predicted that it would surge today and it did. I thought the volume wouldn't be there due to the price, which was somewhat right....the volume was 184,000 with an average of 115,000, but the price still shot up. I replied in a comment this morning that the sellers must have kept their ask price high and the buyers were chasing it up. With a large institutional holding in the stock, the float appears to be very limited.On another note, Cramer actually picked this stock before since I have been writing this blog since I have its intraday chart from the last time. The second chart is from the last time he picked it....it was a much different story then

Last time Cramer picked it:

p.s. I miss my old charts :(

p.s. I miss my old charts :(

Comments on "Update - HEI HLT MOG-A TGI"

post a comment